Published May 2022

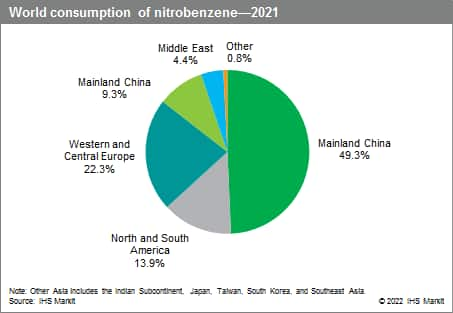

Mainland China is the largest player in the nitrobenzene market, representing 49% of global nitrobenzene consumption in 2021. Mainland China is the dominant force in Northeast Asia, accounting for 84% of the region’s nitrobenzene demand. Western Europe is the second-largest market for nitrobenzene and represents 20% of global nitrobenzene demand as of 2021. Demand for nitrobenzene in Western Europe is forecast to grow at an average annual rate of 2.3% during the forecast period, reaching over 2.1 million metric tons of nitrobenzene consumption in 2026. The United States is the third-largest nitrobenzene market, contributing almost 14% of global consumption in 2021. Demand for nitrobenzene in the United States is forecast to grow at an annual rate of 4.1% during 2021–26, reaching near 1.5 million metric tons by the end of the forecast period. Demand for nitrobenzene in the United States is closely linked to US consumption of aniline. US housing starts and construction/remodeling activity drive the demand for MDI. US nitrobenzene consumption for aniline is projected to grow at an average annual rate of 4.1% per year during the forecast period.

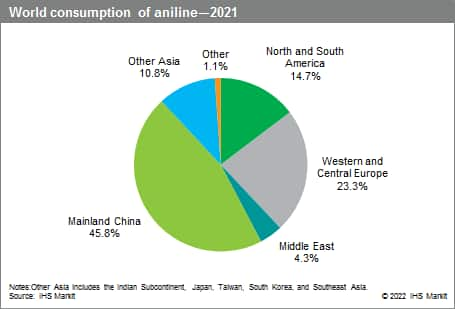

During 2016–21, global aniline consumption grew at an average annual rate of 3.2%, reaching more than 6.8 million metric tons in 2021. MDI global consumption grew by 3.9% per year during the same period, reaching over 7.4 million metric tons in 2021. The global demand for MDI is expected to increase by 3.8% per year during the forecast period. In turn, aniline consumption for MDI will grow at an average annual rate of 3.8% during 2021–26.

The following charts present world consumption of nitrobenzene and aniline:

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook – Nitrobenzene and Aniline is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key Benefits

S&P Global’s Chemical Economics Handbook – Nitrobenzene and Aniline has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability